Bitcoin vs Tether: Key Differences and Consideration

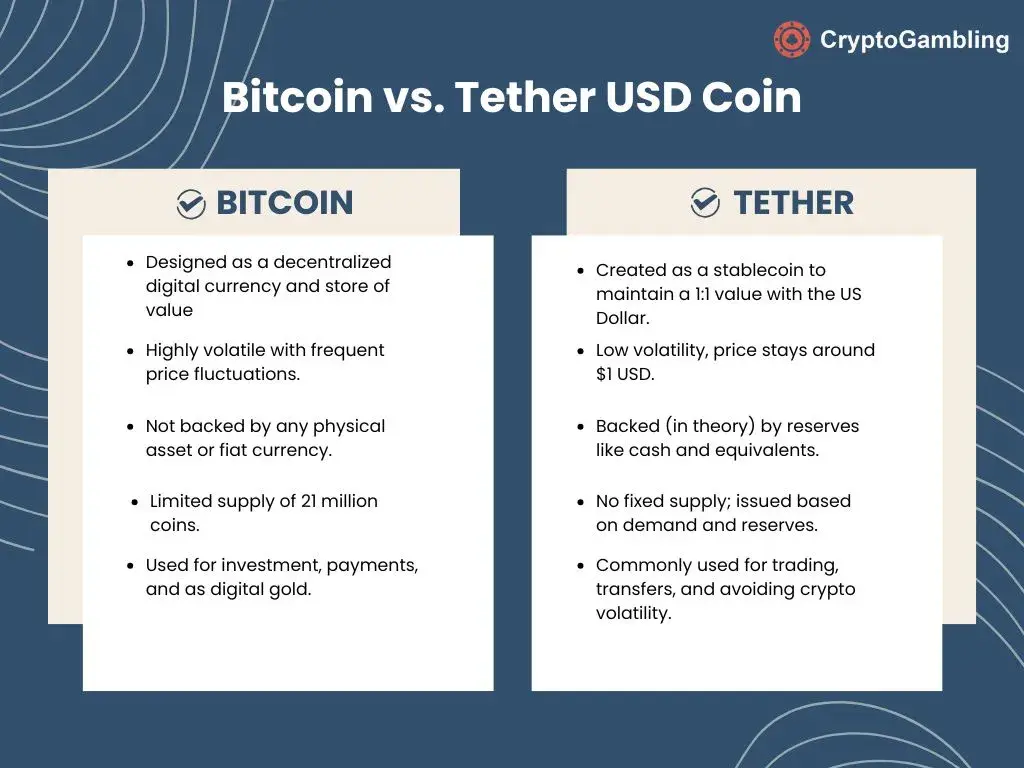

Discover the fundamental differences between Bitcoin and Tether USD Coin. Learn how Bitcoin operates as a decentralized cryptocurrency, while Tether functions as a stablecoin pegged to the US dollar. Understand their use cases, volatility, and market roles.

Digital currencies have transformed societal notions about financial systems. Bitcoin, along with Tether USD Coin, stands as two renowned digital currency types in the market today.

People who want to understand the digital currency market need to learn about the distinct features of these coins.

Bitcoin operates as a crypto asset while maintaining popularity for its fluctuating market value behavior. Bitcoin maintains highly unpredictable price movements because of which it classifies as a volatile digital currency.

Hundreds of thousands of investors choose to buy Bitcoin as they expect its market value to increase in the future.

People who accept the potential benefits of financial risk choose Bitcoin investment because of its volatility potential.

The stablecoin designation belongs to Tether USD Coin which operates under the USDT title. USDT has been designed to keep its value fixed at $1, which corresponds to the dollar rate.

Tether USD Coin provides price stability that benefits individuals who wish to minimize large market fluctuations.

The coin functions as a standard method for currency swaps when trading among multiple cryptocurrencies.

The functions of Bitcoin and Tether as digital currencies stand in direct opposition to each other. Bitcoin enables users to earn substantial profits although this opportunity includes increased volatility risks.

Tether serves as a stable investment, which makes it better for some application requirements. The cryptocurrency comparison tool assists investors in discovering which cryptocurrency best suits their requirements.

The following blog examines the safety aspects together with the financial advantages of Bitcoin and Tether.

Investors who understand the relationship between stablecoins and volatile cryptocurrencies will be able to select better digital currency solutions.

This guide delivers straightforward and useful information to both beginners in the crypto world and experienced users

What is Bitcoin?

An anonymous operator under the name Satoshi Nakamoto created Bitcoin as a digital currency in 2009. The system of Bitcoin functions autonomously from centralized authority which differs from government-controlled money.

Its operation remains outside of any person's control or authority, as well as any company or nation-state.

Task of transaction and record keeping for Bitcoin can be found in the form of a secure network shared over a series of computers spread across the entire world.

Blockchain technology is the central technology of Bitcoin. Blockchain is an open book that keeps all transactions of Bitcoin.

The ledger system exists in multiple computers simultaneously which provides both visibility and protection.

Bitcoin transactions become part of a block every time a person sends digital currency to another user.

The different blocks combine into a single chain that gives its name to the system: blockchain.

The Bitcoin network uses mining as its transaction verification method that maintains security and accuracy for all transactions.

The mining process requires capable computer systems that individuals or organizations operate to solve advanced mathematical operations.

The process of problem-solving allows miners to verify transactions before appending them to blockchain records.

The mining operation awards miners bitcoin tokens as compensation for their computing efforts.

New Bitcoin creation occurs through this system, which makes it an essential component of the Bitcoin framework.

The value of Bitcoin experiences significant price swings that are well-known throughout the market. Short-term periods often result in abrupt changes to its market worth.

High returns attract investors to Bitcoin because of its price fluctuations, although these changes increase investment risks.

The finite nature of Bitcoin, together with its value preservation ability, makes users consider it similar to digital gold.

The decentralized cryptocurrency Bitcoin works on a transparent blockchain system. Investors can take advantage of Bitcoin through its potential returns, but they must be aware of its market volatility.

The digital currency market requires fundamental knowledge of Bitcoin operation for those who want to participate in it

| Get upto $20,000 Bonus at BC Game |

|---|

What is Tether (USDT)?

Tether (USDT) is a type of cryptocurrency known as a stablecoin. Unlike other cryptocurrencies that can change in value quickly, Tether is designed to stay equal to the U.S. dollar. This means 1 USDT is usually worth $1.

This stability makes it useful for people who want to avoid big price swings in the digital currency market.

Tether achieves its stability by holding reserves that match the amount of USDT in circulation. These reserves include cash and other assets.

However, Tether has faced criticism for not always being transparent about its reserves.

In the past, it was fined for claiming full backing without proper evidence. Despite this, Tether remains widely used in the cryptocurrency world.

One reason for Tether's popularity is its high liquidity. It is accepted on most crypto exchanges and is often used to trade other cryptocurrencies.

This makes it easier for investors to move money quickly without converting to traditional currencies.

Tether's stability and ease of use make it a common choice for traders looking to avoid the risks of more volatile crypto assets.

Tether is managed by a company called Tether Limited. They are responsible for issuing USDT and maintaining its peg to the dollar.

While Tether has made efforts to improve transparency, it still operates with less regulatory oversight compared to some other stablecoins.

This has led to ongoing debates about its role and reliability in the digital currency market.

In summary, Tether (USDT) is a stablecoin that offers a way to hold digital assets with minimal price changes.

Its stability makes it a useful tool for traders and investors who want to avoid the volatility of other cryptocurrencies.

However, it's important to be aware of the discussions around its transparency and regulatory status when considering its use.

| 400% upto $10,000 + 300 Free Spins: Just for You in Wild IO |

|---|

Bitcoin vs Tether: Core Differences

Bitcoin exists as a popular cryptocurrency, while Tether functions to maintain steady values.

Tether maintains a stable market value because its goal is to maintain stability, while Bitcoin experiences frequent price shifts.

Understanding the characteristic contrasts between Bitcoin and Tether enables investors to select better cryptocurrency options in the market.

As a digital currency, Bitcoin operates without a central authority to manage it. The system operates without any centralized authority holding control over it. Bitcoin's price swings rapidly because its market value displays strong volatility.

Users invest in Bitcoin primarily to benefit from its anticipated price appreciation over the years. The Bitcoin investment system attracts risk-tolerant individuals because of its potential profit opportunities.

The digital currency Tether operates as USDT under the stablecoin category. The token maintains its fixed value because it has a direct relationship with the U.S. dollar currency.

Its fixed value at USD$1 allows Tether to serve users who want to protect their investments from excessive price volatility.

Cryptocurrency serves as a primary tool for trading activities across different cryptocurrencies as well as money transfers between them.

The main functions of Bitcoin and Tether represent two separate use cases in the cryptocurrency market. High returns through Bitcoin investment require investors to accept a significant level of uncertainty.

Tether functions as a secure alternative because of its stable nature. The cryptocurrency comparison tool enables investments to pick the cryptocurrency that best meets their requirements

Bitcoin demonstrates a volatile nature through its high potential returns that need to be considered alongside its associated dangers. Tether operates as a stablecoin that maintains stable value throughout its lifetime.

Investors who study the advantages and disadvantages of digital currencies within the market make better decisions when they engage in digital currency trading.

Crypto Risks and Benefits

The investment in Bitcoin and Tether cryptocurrencies provides investors access to dual benefits and demanding conditions. Knowledge of these characteristics enables investors to form well-informed decisions for the digital currency market.

Cryptocurrencies provide the advantage of elevated return potentials to their users. Bitcoin has gained numerous investors because it experienced substantial price growth across multiple years.

The decentralized structure eliminates a single point of control, so people now possess an alternative system to manage and distribute value. A volatile crypto exists due to its price fluctuations, which occur quickly.

The crypto market finds stability through Tether. Being a stablecoin Tether has its value correlated to the U.S. dollar value and aims to preserve price stability.

The fixed exchange rate between Tether USD and U.S. dollars gives this crypto asset value for trading purposes and protects users from market volatility with other currencies.

The stable coin is employed as a matter of routine to swap money between crypto exchanges and to maintain market exposure without selling out.

The advantages of Tether possess some underlying risks that should be considered by investors. Without the regulation of cryptocurrency, traditional asset regulation is nonexistent, leaving investors with security concerns.

Investors encountered substantial financial losses due to exchange hacks that happened on several occasions.

Investors face less protection because no governing body exists to regulate the space when fraud occurs or when assets are mismanaged.

Although cryptocurrencies present numerous enticing features they simultaneously create substantial risks to users.

Bitcoin investing leads to profitable returns, though it features strong market volatility. Tether offers better stability, yet it contains specific risks that investors need to consider.

The process of comprehending crypto risks together with benefits represents an essential requirement for people who wish to invest in this field.

| Claim upto 150,000 USDT at FortuneJack |

|---|

The Future of Bitcoin and Tether: What Lies Ahead for Investors?

In the world of digital currency, the distinction between Bitcoin and Tether (USDT) has become crucial for cryptocurrency investors.

Bitcoin, defined as a decentralized digital currency since there is no central authority and peer-to-peer transactions on a distributed ledger called blockchain, was created in 2009.

Because it is decentralized, it is volatile, with prices witnessing huge fluctuations with respect to market demand, investor sentiment, and macroeconomic factors.

Tether is a stablecoin launched in 2014, designed to keep its price stable by pegging it to that of an equivalent amount in U.S. dollars.

This Tether USD stability will be achieved by comprising various reserves of cash, U.S. Treasury bills, and other assets in order to hold that a U.S. dollar backs each USDT token.

Tether reported in August 2024 that it had reserves worth $118.4 billion - which includes $5.3 billion in excess reserves - thus reaffirming its commitment to keeping people stable in the digital currency market.

The diverse parts of Bitcoin and Tether pose special opportunities and considerations to investors. Whereas the high-risk investor most suitable for long-term investment opportunities in the growth of the cryptocurrency market prefers Bitcoin for its potential high return.

Tether also offers stability, which can be beneficial during periods of market dislocation or for investors who want to hedge their capital in the crypto space.

It must be pointed out that Tether offers stability but at the expense of risks. Perceived scrutiny abounds with respect to the transparency of reserves of the company. The past regulatory actions were given as an example to establish the need for due diligence.

Investors ought to keep these factors in mind if they consider Tether as part of their digital asset portfolio. The regulatory environment surrounding digital currencies continues to evolve and may be relevant for the operations and stability of Tether and Bitcoin.

Bitcoin vs Tether Coin | Which One Is Recommended for Investors?

Bitcoin is equal to Tether as an investment alternative since all other choices fit the particular investment objectives and risk tolerance of investors.

The delivery risks of Bitcoin comprise high possible appreciation as well as intense market price fluctuations. Clients requiring value stability benefits must utilize Tether since it functions stably.

Bitcoin is volatile globally for its extremely unpredictable price action. The price of the asset traverses large ranges in small time frames

Investors who want big returns back Bitcoin, although this crypto demands an acceptance of significant risks in return. Bitcoin investment requires a deliberate assessment together with market adjustments acceptance from investors.

Tether's stablecoin facet maintains its price within a range that closely adheres to the value of the U.S. dollar. Due to the comparably stable nature of Tether USD, it is an optimal choice investment device for investors that do not prefer to take the risk of variability in cryptocurrency price.

People utilize Tether mainly for trading and fund transfers along with asset storage purposes which avoids market volatility.

People should examine Bitcoin and Tether comparisons based on their unique investment methods. People who focus on enduring wealth expansion and embrace risky ventures typically choose to invest in Bitcoin.

Investors who need stability together with reduced risk tend to select Tether over other cryptocurrencies. The comparison shows that selecting proper cryptocurrencies requires matching financial investments to specific investment aims.

Digital currencies maintain separate functions in which both Bitcoin and Tether play vital roles. The evaluation process of crypto risks and benefits between different currencies helps investors define sound investment choices.

A successful cryptocurrency selection depends on matching personal risk capacity and financial targets with suitable digital currency choices.

| Get 590% Up to $10 500 + 225 Free Spins at Betfury |

|---|

Conclusion: Final Thoughts

You need to consider both the potential for profits and risk factors when investing in cryptocurrencies. Bitcoin serves as the foil to Tether in the cryptocurrency market due to its differing target audiences.

Bitcoin provides huge price volatility through which investors can gain enormous returns. Investors who seek growth opportunities choose this volatile cryptocurrency dimension because they accept market price volatility.

The market unpredictability of Bitcoin leads to both major gains and significant price reductions.

The stablecoin Tether operates with a value that remains nearly equivalent to the U.S. dollar. The fixed value of Tether USD creates a protective environment for investors who want to prevent the extreme market volatility commonly found in other cryptocurrency platforms.

People use Tether primarily for payments and maintaining assets in a volatile market environment.

Investors need to make a choice either in Bitcoin or Tether based on their own investment strategy. The long-term growth strategy and adoption of higher risk levels strongly supports investing in Bitcoin.

Investors requiring stability with less risk utilize Tether as the first choice. The comparison validates cryptocurrency alternatives must always be aligned with people's specific financial goals.

The cryptocurrency market has beneficial elements from both Bitcoin and Tether networks. Those investors who require assistance in deciding should examine the risks and advantages offered by the utilization of cryptocurrencies.

The choice between the possible appreciation of Bitcoin or Tether stability must be made according to personal risk appetite and investment objectives.