Bitcoin Explained: Everything You Need to Know About Investing, Mining, and Regulations

Explore Bitcoin comprehensively: its origins, functioning, investment approaches, mining processes, legal aspects, and future prospects. This guide caters to both novices and seasoned experts, offering an all-encompassing understanding of the world's leading cryptocurrency.

Bitcoin Explained: Everything You Need to Know About Investing, Mining, and Regulations

Cryptocurrency has taken the financial systems of the world by storm. The introduction of digital currency has changed the way we perceive money, transactions and investment. However, this change did not happen overnight.

The origin of Bitcoin, commonly known as BTC, paved the path for disruptive innovation in the economic system. Introduced in the market in 2009 as the first decentralized digital currency, BTC has arguably been the most popular cryptocurrency. That being said, other crypto money like Ethereum are becoming more prominent every day.

This innovation has brought change in everything from trading and investing to crypto gambling and transactions while opening doors for unlimited possibilities. So, you must know everything about this tokenized money system to stay updated in today’s competitive and innovative market and stay relevant.

If you are someone who wants to start their journey in the crypto world or an investor who wants to diversify their portfolio, this blog is for you as we will cover everything you need to know about Bitcoin from investing, mining and its history.

Let’s Start.

What is Bitcoin?

Bitcoin (BTC) is a cryptocurrency, or virtual currency, that is not controlled by any one individual, organization, or group. It is intended to function as money and a mode of payment. This eliminates the requirement for financial transactions to involve a reliable third party, such as a bank or mint.

BTC is a digital currency with the objective of eliminating the necessity for centralized entities like governments or banks to make any transactions. It uses blockchain technology for security measures and cryptography for transaction verification., which totally eradicates the need for any regulatory third party.

This means with e-money, traditional fiat currencies like the US Dollar, Euro, and Pound Sterling are becoming somewhat obsolete. For instance, people have started making purchases and investments via these digital assets.

Here are a few things you should remember about the digital money:

-

It lacks intrinsic worth because it cannot be exchanged for another good, like gold, silver or any other commodity.

-

It exists simply in the network and has no physical form.

-

The network is entirely decentralized, and the protocol—rather than a central bank or any other body determines its supply.

Importance of Bitcoin in Today’s Market

Bitcoin has made significant changes in today’s market by addressing several issues and points of the general masses. Here are some of the core reasons why BTC currency is getting so popular nowadays.

Decentralized Currency

BTC works on a decentralized blockchain system, which means that there is no need for any regulatory bodies like banks, government or other parties to control the flow in the market. This allows people to have autonomy in decision-making regarding their finances. Individuals who belong to countries with strict financial regulations and unstable economies can benefit greatly from this digital asset.

Lower or No Transaction Fees

Another reason why this crypto has become so important and popular among the people is its fees. In comparison to the general banking system, the transaction fees for this emoney are very low or negligible in many cases. Furthermore, as it operates on blockchain technology, transactions are very fast. This speed really stands out during international transactions.

Great Investment Platform

This digital asset has limited availability, with 21 million coins. This means individuals cannot mine any more BTCs after it reaches this level. As it is scarce, people view it as digital gold and invest in it. As a result, it is a great asset for portfolio diversification in addition to being a medium of exchange and trading. This also protects this asset from inflation.

Secure Means of Transaction

BTC transactions are transparent and less likely to be fraudulent since they are protected by encryption and are documented on a public ledger or blockchain. However, as with every asset, BTC is not 100 percent safe as there are hackers and scammers out there looking to find loopholes in the security measures. That being said, it is much safer than other transactions and assets.

What is Blockchain Technology and How is it Used in Crypto?

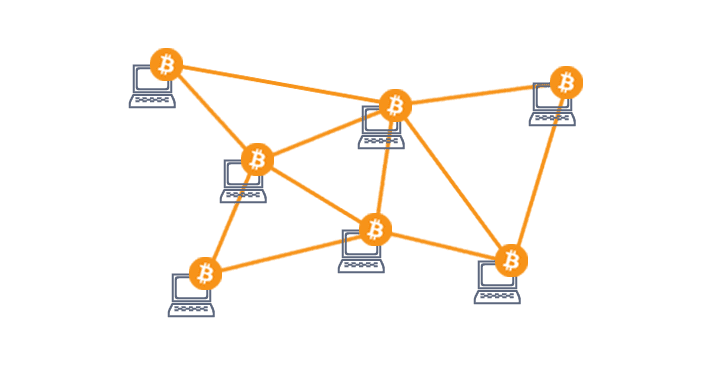

Blockchain technology is the decentralized ledger of every transaction made over a peer-to-peer network. Participants can use this technology to validate transactions using this technique without a central clearing authority's assistance.

Now, talking about how blockchain is used in this crypto. BTCs are an electronic exchange medium created and maintained on the blockchain. It is controlled by an algorithm that controls the production of monetary units and uses cryptographic techniques to validate the transfer of funds.

Here is a step-by-step process of how blockchain technology works:

-

Step 1: Someone initiates a transaction request.

-

Step 2: A P2P network made up of computers, or nodes, receives the requested transaction.

-

Step 3: Using a well-known algorithm, the network of nodes verifies the transaction and the user's status.

-

Step 4: Contracts, records, money, and other data are processed in the validated transaction.

-

Step 5: The transaction is joined with other transactions to form a new block of data for the ledger when it has been validated.

-

Step 6: After that, the new block is permanently and irrevocably added to the current blockchain.

-

Step 7: The transaction is finalized and completed.

Blockchain brings several benefits to the table, including enhanced transparency and security, a permanent ledger, cost reduction in transactions and accurate tracking.

History of Bitcoin

Although many believe that BTC is something more recent, the story of this crypto started nearly two decades ago. The concept of e-money with no regular body was in the plan for a long time. However, it was made possible only in 2009 when it was made available to the public. So, let us briefly cover the history of this pioneer crypto.

The Origin of Bitcoin

The first crypto was founded in January 2009 by a person or a group of persons known as Satoshi Nakamoto, whose identity has never been confirmed. This name is considered to be a pseudo-name.

In a 2008 white paper, the mysterious creator of BTC announced the blockchain system, titled "Bitcoin: A Peer-to-Peer Electronic Cash System,” which is the foundation of the cryptocurrency market.

Bitcoin Genesis Block (2009)

The Genesis Block, the original BTC block, was mined by Nakamoto in January 2009. This was the beginning of Crypto. Fifty coins were awarded for mining this block. The fact that

Nakamoto included the following statement in the Genesis Block, which is intriguing: "The Times 03/Jan/2009 Chancellor on the brink of the second bailout for banks." This may be interpreted as a clear critique of the established financial system and the demand for substitutes like BTC.

The Bitcoin price in 2010 was basically nothing but raised to less than $0.01 in May of 2010. It touched the price of a dollar in February 2011. Now, at the time of this writing, 16 years after it was made available to the public, the value of BTC is over $95,000 with slight volatility.

Bitcoin all time high came on December 4th, 2024, with the value of $109,026.02.

Here is a timeline for some of the key moments in the history this first cryptocurrency adaption.

-

Pre-Crypto: The "godfather of cryptocurrency," American cryptographer David Chaum, introduced the concept of anonymous electronic money, or eCash, in 1983. In 1989, he introduced Digicash, but it was never widely used.

-

2008: This year saw the publication of Bitcoin: A Peer-to-Peer Electronic Cash System by an unidentified individual or individuals going by the name Satoshi Nakamoto.

-

2009: This year saw the introduction of decentralized digital currency to the globe with the birth of BTC.

-

2010: The units of the new cryptocurrency could not be given a monetary value because it had only ever been mined and never exchanged. For the first time, someone sold theirs in 2010, exchanging 10,000 of them for two pizzas. At today's pricing, those coins would have been worth almost $100 million if the buyer had held onto them.

-

2011: The first rival cryptocurrencies emerge as Bitcoin gains traction and the concept of decentralized and encrypted currency gains traction. Often referred to as altcoins, these aim to enhance the original BTC design by providing increased speed, anonymity, or some other benefit. Namecoin and Litecoin were among the first to appear.

-

2013: Forbes awarded BTC the year's best investment.

-

2014: Bloomberg changed the story by saying that BTC was the worst investment of the year.

-

2016: Introduction of Ethereum, the biggest competitor of Bitcoin.

-

2017- Present: Bitcoin value remains the top crypto with the highest price.

Where and How to Use Bitcoin

Crypto is becoming a mainstream digital currency used for both offline and online payments. Its quick processing and decentralized system have attracted various financial activities. Some of the uses of crypto in everyday life are outlined below.

Online and Offline Stores

First, Crypto is commonly used in online and offline stores in the countries where it is regulated. Most businesses in Canada, the USA, and EU accept BTC as payment, both online and in stores. Major retail websites like Microsoft, Overstock, and Newegg offer Crypto as an option for buying software, electronics, and other items.

In travel, Expedia, CheapAir, and Travala permit bookings of flights, hotels, and car rentals through cryptocurrency. Further, some food chains, such as Pizza Hut in some locations and local restaurants, have started taking digital asset payments through Bitcoin QR codes. Crypto-friendly cities such as Miami, Zurich, and Tokyo already have numerous shops that accept payments in crypto, which reflects how popular digital money is becoming.

Investment

Bitcoin investment has gained much traction as a digital currency, serving as a store of value or an inflation hedge. As a finite supply of 21 million coins, B is being compared to gold, and the majority of investors view it as a long-term Bitcoin stock investment that would outperform traditional assets.

Bitcoin's decentralized nature and existence outside traditional financial networks render it appealing to those seeking diversification or as a hedge for economic uncertainty. It is typically purchased through exchanges like Coinbase or Binance and stored in digital wallets—either hot (connected to the internet) or cold (offline for security).

Likewise, people have started using BTC for NFTs and other kinds of digital assets.

Bitcoin ATMs

There has been an introduction to Bitcoin ATMs (BTMs) in major cities of the world. Crypto ATMs offer a simple method to buy and sell BTC using cash or cards. BTMs are usually found in malls, gas stations, and convenience stores, with the U.S. and Canada having the highest number of BTMs.

Using a BTMs is easy. Here is how it works

- Insert cash

- Scan the QR code of the crypto wallet

- The crypto is instantly received.

Some ATMs also support selling Bitcoin and withdrawing cash. To find the nearest BTC ATM, visitors can visit websites like CoinATMRadar.com, which provides location maps and transaction details. BTC ATMs are an ideal option for individuals who want to use cash to buy digital currency without registering on an exchange.

Crypto Gambling

BTCs is popular for online crypto gambling due to fast, anonymous transactions. Bitcoin casino such as Wild.io, BC.Game, Winz.io, Run4Win, Fairspin, and BetFury accept BTCs for poker, slots, and sports betting. Canada, among many other nations, has become a hub for crypto gambling and bitcoin betting. For Canadian players, bitcoin casino Canada options are increasing, offering secure, local-friendly platforms for gambling.

Players enjoy rapid withdrawals and additional privacy without sharing banking details. However, choosing licensed and reputable platforms is essential to ensure safety.

Peer-to-Peer Transactions

Peer-to-peer (P2P) transactions are one of the core functions and use of BTC, enabling individuals to transfer money directly to one another without the involvement of intermediaries. It is a popular way of buying and selling Bitcoin, as well as transferring money to friends or business partners.

P2P sites such as LocalBitcoins, Paxful, and Bisq connect buyers and sellers, typically with escrow services that are secure to enable risk-free transactions. In addition, users can easily send Bitcoin using digital wallets by sharing the wallet address or QR code. P2P transactions are valued for privacy, low transaction costs, and fast processing times, especially for cross-border payments.

Institutional Investment

Major market players such as Tesla, MicroStrategy, and Square have invested significantly in crypto as a treasury reserve policy, viewing it as an inflation hedge and as a store of value. Institutional investors have viewed the corporate adoption as a legitimizer of BtC.

At the same time, the creation of Bitcoin ETFs (Exchange-Traded Funds) has provided greater ease to institutional and retail investors by providing a regulated fund to invest in crypto without actually possessing the underlying cryptocurrency.

Additionally, companies like PayPal, Visa, and Mastercard have integrated Bitcoin and other cryptocurrencies within their payment processes, allowing customers to buy, sell, and use digital currency to make purchases, thereby providing broader mainstream adoption.

International Remittances

Crypto is a fast and cheap way to move money across borders. As compared to banks or remittance firms, Bitcoin transfers are cheaper and will take only a few minutes to complete. It is easy to send digital assets to a foreign relative or friend via platforms such as Strike, BitPay, and Coinbase. This is particularly useful for foreign workers who wish to send remittances back home.

Moreover, the recipients can exchange BTC for local currency through crypto exchanges or Bitcoin ATMs. Crypto remittances are also gaining popularity as an alternative to services such as Western Union or MoneyGram, particularly in countries with poor banking infrastructure.

How to Invest in Bitcoin?

It is possible to invest in Bitcoin on various platforms and channels, each of which is appropriate to the individual's needs. The majority of popular cryptocurrency exchanges like WealthSimple Crypto, Shakepay, and Bitbuy offer the possibility of purchasing Bitcoin in local currency.

They are licensed and offer user-friendly interfaces, which are appropriate for both beginners and experienced traders. Paxful and LocalBitcoins also provide peer-to-peer (P2P) platforms through which you can buy crypto directly from individuals using various payment methods, such as bank transfers or cash-in-hand payments.

After buying crypto, it is important to keep it secure in a digital wallet. Nano Ledger X, Coinomi, and Electrum are some of the safest wallets for keeping your Bitcoin secure.

How to Buy Bitcoin

Buying BTC is a very simple process. You can follow the following step-by-step guide to buy your very first crypto currencies.

-

Start by choosing a reliable exchange such as Coinbase, Binance, or Kraken

-

Sign up for an account and finish the verification process (KYC) with ID and proof of residence

-

Fund your account via bank transfer, credit card, or PayPal

-

Once funded, enter the desired amount

-

Confirm your order

-

For additional protection, transfer your digital assets to a private wallet

Buying BTC is as simple as that.

Bitcoin Trading Strategies

There are many ways you can trade BTC in the open market; however, the most popular ones are HODLing, Day Trading and Futures. Let us dive deep into what they really are.

HODLing involves buying and holding cryptocurrency in the long term, so it is particularly appropriate for new investors who appreciate a simple and low-maintenance approach. Day trading relies on short-term price fluctuations and requires much market knowledge and rapid reflex decision-making abilities.

Finally, futures trading allows investors to wager on the future price of Bitcoin using contracts that can be extremely rewarding and, at the same time, extremely risky.

Bitcoin Halving and Its Impact on Price

The term "Bitcoin halving" describes a 50% reduction in the block reward that occurs about every four years. During this process, there is more scarcity, which might lead to an increase in price if market circumstances stay the same because fewer BTCs are entering the market.

The blockchain's automated procedure for approving transactions and creating new blocks, known as mining, includes block rewards if they are the first to solve a cryptographic puzzle, Bitcoin miners or participants in a race to solve it and get fresh coins.

BTC was last halved on April 20, 2024, yielding a 3.125 BTC block reward.

Tax Implications for Bitcoin Investors

Bitcoin profits are typically treated as capital profits, with investors filing gains and losses with the local tax authorities. Short-term profits on property owned for less than a year are usually taxed at lower rates than long-term profits. Accurate record-keeping of transactions by date, amount, and type is essential.

In addition, some jurisdictions tax Bitcoin staking and mining rewards as taxable income.

Remember: Every country has unique tax laws, so it is best to seek advice from a tax consultant in order to remain compliant, optimize tax techniques, and effectively address liabilities.

What is Bitcoin Wallet?

A BTC wallet, like any digital assets wallet, is a tool that is used to receive, send, and store BTC. A crypto wallet does not store your digital assets, but it stores the keys, both private and public, which are required to access the crypto holdings on the blockchain technology.

The crypto wallets are generally divided into two types, namely Hot Wallets and Cold Wallets. They both have completely different features, and their use depends on the specific needs of the users. So, let us understand what hot wallets and cold wallets are.

Hot Wallets

Hot wallets are online, which makes them ideal for regular transactions. On the other hand, they are more susceptible to hacking and other cyber threats because they are online. Hot wallets will be perfect for customers who require instant access to their money for shopping, trading, or using decentralized applications, or simply dApps.

There are various Hot wallets like

-

Mobile Wallets

-

Desktop Wallets

-

Web Wallets

Cold Wallets

Conversely, cold wallets are offline storage choices that provide superior security for extended holding periods. These settings cannot be subject to online hacking because they are offline. They can be perfect for someone who values security over ease of use, particularly if they own a sizable amount of cryptocurrency.

Cold wallets include:

-

Hardware Wallets

-

Paper Wallets

How to Choose Wallets for Your Crypto Needs

Here is a detailed step on how you can choose the wallets based on your needs.

-

Step 1: Establish your needs and choose your primary use case, such as gambling, holding, or trading.

-

Step 2: Evaluate security needs and determine if you require sophisticated security capabilities like cold crypto storage or two-factor authentication.

-

Step 3: Verify supported coins to see if your favourite cryptocurrencies are supported by crypto storage.

-

Step 4: Assess compatibility and select cryptocurrency storage that is compatible with the devices you want to use, such as desktops and mobile phones.

-

Step 5: Test user experience while examining several vaults to determine which ones have the most user-friendly interfaces.

-

Step 6: Assess reviews and reputation and find out what the crypto community thinks of this vault by reading reviews of every other vault.

-

Step 7: Assess features like staking, dApp integration, and built-in exchange in your wallet of choice.

-

Step 8: Verify any subscription models, transaction fees, and upfront expenses.

-

Step 9: Verify that the vault offers backup options and a recovery phrase.

-

Step 10: Choose the wallet that best suits your requirements and needs.

What is Bitcoin Mining? How Does it Work?

Bitcoin mining is the process that involves validating and adding new transactions to the Bitcoin blockchain and generating new coins. It involves solving hard mathematical problems with the help of powerful computers, and the miners are rewarded in the form of newly generated coins and transaction fees.

Here is how it works:

The Bitcoin mining process starts When an individual initiates a BTC transaction. When the transaction is initiated, it is transmitted to a group of computers called nodes. Miners gather these transactions into a "block."

After that, miners race against each other to find a cryptographic puzzle from the block data. It is finding a hash which is a letter and number combination that is unique and meets certain criteria set by the network. This process is called Proof-of-Work (PoW). It is trial and error, requiring vast amounts of computing power.

When all of that is done, a miner finds the right hash and the solution is propagated across the network. The nodes verify the work. If found valid, the block is added to the blockchain.

The successful miner is paid with: A block reward (newly generated coins) which has a value of 6.25 BTC but will halve every four years through BTC halving.

Bitcoin Regulations Worldwide

The regulation of BTC varies from country to country. Moreover, there are cases where the regulation for digital currency is different in separate states of the same nation. Knowing how a country or a government views crypto can be essential for you if you want to engage in the crypto world,

Regulations in Major Economies

In Canada, Bitcoin is regarded as a commodity, with exchanges being registered under FINTRAC for AML reasons and capital gains tax charged on transactions.

Similarly, in the US, Bitcoin is treated as property for taxation by the IRS and as a commodity by the CFTC. SEC regulates crypto-backed securities, and exchanges are subject to AML and KYC regulations. There is a specific BitLicense requirement for crypto businesses in New York state.

The European Union enforces AMLD5 regulations, requiring KYC on exchanges, and is rolling out MiCA laws to standardize crypto law across member states.

Finally, China has banned cryptocurrency trading and mining but allows individuals to hold digital currencies while promoting its digital yuan.

Here is a table which shows how the BTC is regulated in the world.

| Country | Regulation Status |

|---|---|

| USA | Regulated |

| Canada | Regulated |

| European Union (EU) | Regulated |

| China | Banned |

| El Salvador | Regulated (Legal Tender) |

| Central African Republic (CAR) | Regulated (Legal Tender) |

| Kazakhstan | Regulated |

| Russia | Grey Area |

| India | Grey Area |

| United Arab Emirates (UAE) | Regulated |

| United Kingdom (UK) | Regulated |

| Australia | Regulated |

| Nigeria | Grey Area |

| South Korea | Regulated |

| Singapore | Regulated |

| Brazil | Regulated |

| Japan | Regulated |

| Mexico | Regulated |

| Turkey | Banned |

| Argentina | Regulated |

| South Africa | Regulated |

| Indonesia | Banned |

| Malaysia | Grey Area |

| Thailand | Regulated |

| Philippines | Regulated |

| Venezuela | Grey Area |

| New Zealand | Regulated |

| Switzerland | Regulated |

| Sweden | Regulated |

| Finland | Regulated |

| South Sudan | Banned |

| Bangladesh | Banned |

| Egypt | Banned |

| Qatar | Banned |

| Iran | Banned |

| Kenya | Grey Area |

| Israel | Regulated |

| Pakistan | Banned |

| Vietnam | Banned |

| Nepal | Banned |

| Morocco | Banned |

Challenges of Cryptocurrency (BTC)

BTC is one of the best things that has happened in the financial market in a long time. However, like every rose has its thorn, this crypto is not safe from issues. Here are some of the most common challenges of decentralized digital assets. These issues have been acting as a roadblock to Bitcoin’s journey to become a mainstream payment and investing tool.

Volatility

Although investing in crypto can sound alluring, it's crucial to realize that crypto has no set value. There is a huge economic risk because the price is only as good as what the next individual is ready to pay.

Only a few days after reaching a record high, the price of the BTC recently dropped by about 11% in a single day. However, there are other risks besides short-term volatility.

Bitcoin price today can be much different from yesterday just because of a small bitcoin news. This means that both the investment and trading of Crypto, like any other cryptocurrency, is very risky and should not be done without having a good understanding of it.

Sometimes, you can make Bitcoin price predictions using tools like Bitcoin Betting wahoopredict, a predictive trading tool.

Scalability

The blockchain of BTC can only handle roughly seven transactions per second (TPS), which results in delayed transactions and expensive fees during periods of heavy demand.

Moreover, as the mining continues, there will be an increase in the volume of digital currencies in the market. In such cases, if there is no proper initiation in enhancing the scalability of this tokenized currency, then the users can face a huge issue in the transaction process, which contradicts the core principle of the digital currency.

Regulatory and Adaptibity Issues

As discussed in the parts above, there are many countries that have not regulated BTCs and strictly ban it. This list includes some of the biggest economies in the world. As some major markets and countries still do not recognize crypto, its authenticity and importance in the overall scenario are seriously hampered.

This can lead to people opting for the traditional fiat currency for transactions and other mediums for investment purposes.

Moreover, many businesses do not accept digital money as a method of payment due to its volatility. For instance, in 2021, Tesla CEO Elon Musk reported that Tesla would not accept e-money as a means of payment due to climate change reason, which led to a fall in the crypto’s price by 10%.

Competition

Since BTC started to gain some traction in the early 2010s, there have been several competitors in this market. For instance, names like Ethereum, Tether, USD Coin, Binance Coin, and Ripple have posed a great threat to the market captured by BTC. Moreover, Dogecoin, Memecoin, and Trumpcoin have also gained quite popularity recently, making BTC’s market holding somewhat obsolete.

Despite all this bitcoin's market cap is the highest, making it safe for investment.

Environment

Crypto mining based on the energy-hungry Proof-of-Work (PoW) consensus algorithm has been a cause of concern because it consumes a lot of electricity and is environmentally degrading. The process involves high-performance hardware to solve computationally intensive cryptographic puzzles, resulting in excessive energy consumption, usually drawn from non-renewable resources.

However there is growing momentum towards sustainable mining, with efforts to power mining operations using renewable energy sources like hydroelectric, solar, and wind power, and green mining initiatives aimed at reducing the carbon footprint of BTC.

Security Concerns and How to Stay Safe

BTC, thanks to blockchain technology and cryptography measures, has some of the safest and most secure transactions and storage. That being said, there are scammers and hackers who are always on the lookout for variabilities to exploit.

As a result, individuals need to understand the security concerns and how to address them before making any move in the crypto world. Here are some of the concerns that you should be mindful of.

Exchange Hacks

Exchange hacks are one of the most common security challenges that you should be concerned about. Centralized cryptocurrency platforms serve as custodians of user funds and, therefore, are the best targets for hackers. Cyberattackers target vulnerabilities to steal cryptocurrencies from user wallets or the reserves of the exchange.

Hackers have stolen from some of the well-known brands, such as Binance, using this kind of hacking. So, we as a public are more vulnerable to these kinds of hacks and hence need to be more careful.

Phishing

Phishing scams are common in every industry, and the BTC market is not an exception. In this scam, the scammers deceive individuals to reveal their sensitive information. They do this by impersonating a trusted platform and can connect with you via emails, social media messages, websites or in some cases, through a call.

So, if you receive any kind of suspicious message, email, or call regarding your information, avoid it at any cost. They may come as a support for account recovery or setting up your backup. Likewise, they can come via website or call and try to convince you to give the sensitive information.

Malware

Malicious software, commonly installed unintentionally via downloads or email attachments, can track user activity and log sensitive information such as private keys or passwords. Clipboard Hijackers and Keyloggers are just a few examples of common malware software which is especially perilous for your crypto assets.

Avoid downloading apps and software from unknown or unverified sites and sources. Likewise, do not open any links which you are not so sure about.

Losing Private Keys

Bitcoin operates on a decentralized network, and private keys are the only proof of ownership. The moment these keys are lost, there is no recovery method. Forgetting seed phrases or losing the physical hardware or hard drives is the most common cause of losing your key.

So, always protect your keys and, if possible, create a backup for them.

Fake Wallets and Scams

Scammers create counterfeit cryptocurrency wallets or initial coin offerings (ICOs) to cheat users. These wallets would act as normal until a large balance is deposited, after which the funds are stolen. Among the common reasons behind them are wallet applications on third-party app stores or ICO projects offering high returns and disappearing after investment.

How to Stay Safe?

Here are some things that you can do to protect yourself from hacking, scamming or losing your hard-earned cryptocurrencies.

-

Choose well-known wallets with strong security features (e.g., Ledger, Trezor for hardware, MetaMask or Trust Wallet for software).

-

Secure your accounts with 2FA to give an extra layer of security. Don't use SMS-based 2FA; use authentication software such as Google Authenticator.

-

Use cold storage and hardware wallets if you are planning to store your crypto for a long time. Store backups of your seed phrases offline in secure locations.

-

Download wallets or trading apps only from official websites or authentic platforms. Avoid clicking on arbitrary links.

-

Never share private keys or recovery phrases. Avoid "get-rich-quick" plans, giveaways, and unsolicited investment offers.

-

Avoid exchange hacks by using decentralized exchanges that allow you to maintain control of your private keys.

-

Keep your wallets and devices updated with the latest versions to patch security vulnerabilities.

-

Use VPNs and avoid public Wi-Fi while accessing your exchanges or wallets.

-

Multi-sig wallets require the utilization of multiple private keys for transaction approval, thereby adding an extra layer of security.

-

Create alarms for any activity in your account and monitor your transaction history on a regular basis.

Also Read: Top Security Tips and Proven Strategies to Protect Your Cryptocurrency

Bitcoin Vs Other Crypto Currencies

Here is a table of comparison between BTC with other competitors in the market.

| Feature | Bitcoin (BTC) | Ethereum (ETH) | Binance Coin (BNB) | Cardano (ADA) |

|---|---|---|---|---|

| Launch Year | 2009 | 2015 | 2017 | 2017 |

| Creator | Satoshi Nakamoto | Vitalik Buterin and others | Changpeng Zhao (Binance) | Charles Hoskinson and team |

| Consensus Mechanism | Proof of Work (PoW) | Proof of Stake (PoS) | Proof of Stake (PoS) | Ouroboros PoS (Proof of Stake) |

| Transaction Speed | 7 transactions per second (TPS) | 30 transactions per second (TPS) | 1,500 transactions per second (TPS) | 250+ transactions per second (TPS) |

| Supply Limit | 21 million BTC | No fixed supply limit | 165 million BNB (inflationary model) | No fixed supply limit |

| Use | Digital gold, a store of value | Decentralized applications (smart contracts) | Exchange-based utility token | Smart contracts, decentralized applications |

| Energy Consumption | High (due to PoW) | Lower than BTC (due to PoS) | Lower (PoS-based) | Very low (PoS) |

| Market Capitalization | Largest in the market (as of now) | Second largest in the market | Fourth largest in the market | Sixth largest in the market |

| Smart Contract Support | No | Yes | Yes | Yes |

| Decentralization | Highly decentralized | Highly decentralized | Centralized (associated with Binance) | Highly decentralized |

| Popular Use | Store of value, digital payments | Decentralized finance (DeFi), NFTs | Exchange fees, DeFi, and Binance ecosystem | DeFi, smart contracts, scalability focus |

Conclusion

Bitcoin, ever since it was introduced in 2009, has revolutionized the world of finance as the first-ever decentralized digital currency in the world. Founded on blockchain technology, it offers transparency, security, and freedom from the traditional financial system. It has a supply limit of 21 million coins, and because of this, This crypto is often compared to "digital gold," which makes it popular for investment, trading, and everyday use.

This guide has taken BTC through its history, technology, use, and investment strategies, as well as its regulatory framework and challenges. Whilst this tokenized currency offers significant advantages, it also presents risks like volatility, size limitations, and security threats.

To stay safe, use proper wallets, enable two-factor authentication, and use cold storage for long-term holding. As BTC gets older, it is still a revolutionary power in finance.

Some CommonQuestions

1. How Much Is One Bitcoin?

The price of one bitcoin at the time of this writing is $97,397.23 or 138,270.33 CAD.

2. When Is Bitcoin Halving date?

The next BTC halving will most likely occur in 2028 when the block reward will drop to 1.625 BTC.

3. How To Buy Bitcoin?

You can buy Bitcoin with the help of cryptocurrency exchanges like Coinbase, Binance, and Kraken. Make an account, verify your identity, submit a payment method, and finally purchase Bitcoin.

4. How To Buy Bitcoin In Canada?

In Canada, you have options like Bitbuy, Newton, or Wealthsimple Crypto, where you can buy Bitcoin. Interac e-Transfer and wire transfers are widely used payment methods.

5. How To Mine Bitcoin?

Bitcoin mining is conducted with dedicated hardware (ASIC miners) and mining programs. Miners solve difficult mathematical equations to verify transactions and earn digital assets.

6. What Is Bitcoin Halving?

BTC halving is when the mining reward is reduced in half, which occurs around every four years to regulate digital assets supply.

7. What Is Bitcoin Mining?

Crypto mining is the act of validating transactions and adding them onto the blockchain using powerful computers.

8. How Do You Mine For Bitcoin?

You can mine for BTC by using specialized mining equipment and become a member of a mining pool for increased opportunities to receive rewards.

9. How Can I Mine Bitcoin?

Buy an ASIC miner, set up crypto mining software, and join a mining pool.

10. Why Is Bitcoin Dropping?

Prices of BTCs might decrease due to sentiment in the market, different news, regulatory developments, or macroeconomic occurrences. However, it is not permanent.

11. Why Is Bitcoin Going Up?

BTC is going up with rising demand, favourable market sentiment, and institutional investing.

12. When Did Bitcoin Start?

BTC started in January 2009, when the Genesis Block was created by Satoshi Nakamoto.

13. When Is Bitcoin Halving 2024?

The 2024 Bitcoin halving took place in April 2024.

14. How Many Bitcoins Exist?

There are 21 million coins available, and over 19 million of them have been mined.

15. Is Bitcoin A Good Investment?

Crypto is a risky investment with high returns. So, you should do your research, watch for volatility, and see an advisor before making any investments.

16. How Does Bitcoin Work?

Crypto currencies use blockchain technology to record transactions securely without the need for a central authority.

17. Will Bitcoin Crash?

Crypto is volatile, and while it has crashed before, long-term trends are governed by demand and regulation.

18. How Many Bitcoins Are There?

There are 21 million coins which can be mined.

19. How Much Bitcoin Is Left?

There are about 1.4 million BTCs left to mine.

20. When Was Bitcoin Invented?

BTC was developed in 2008 with the release of its white paper and went live in January 2009.

21. Where Can I Buy Bitcoins With Cash?

You can buy BTCs with cash via Crypto ATMs, or Bitcoin machines or visit local P2P exchanges.

22. Where Do I Purchase Bitcoins?

You can purchase from known exchanges like Coinbase, Kraken, or Binance.

23. Bitcoin Price In Canada?

The BTC price in Canada at the time of this writing is 138,270.33 CAD

24. Who is Satoshi Nakamoto?

Satoshi Nakamoto is the pseudonymous creator of crypto who published the BTC whitepaper "BTC: A Peer-to-Peer Electronic Cash System" in 2008. Nakamoto created the first blockchain and launched BTC in January 2009 by mining the Genesis Block (Block 0).