How to Choose the Best Crypto Wallet for Your Needs: A Complete Guide

Finding the ideal crypto wallet is crucial for securely managing digital assets. This guide covers hot wallets for quick transactions, cold wallets for long-term storage, security, supported cryptocurrencies, and usage preferences. Stay secure and invest smartly!

The Cryptocurrencies market worldwide is projected to have a market volume of US $45.3 billion in 2025.

Cryptocurrencies have taken over how one perceives or uses money in its entirety. For example, cryptocurrency offers decentralization, transparency, security, and lower transaction costs. All this has contributed towards making crypto certainly one of the best means through which payments could be either sent or received. However, the same cryptocurrency could act as a headache for you when you do not manage it properly.

When engaging with digital currencies, one of the most important things to remember is to use a suitable crypto vault. You should not take it so lightly to decide on what kind of digital storage you may prefer, considering this is more of a medium of transaction rather than just a place for storing your digital money.

Great, now you have decided to opt for a good e-money wallet for your digital currency. Let's dive right in, covering everything you need to know about cryptocurrency vaults and how you can choose the best to suit your needs.

What Is a Crypto Wallet?

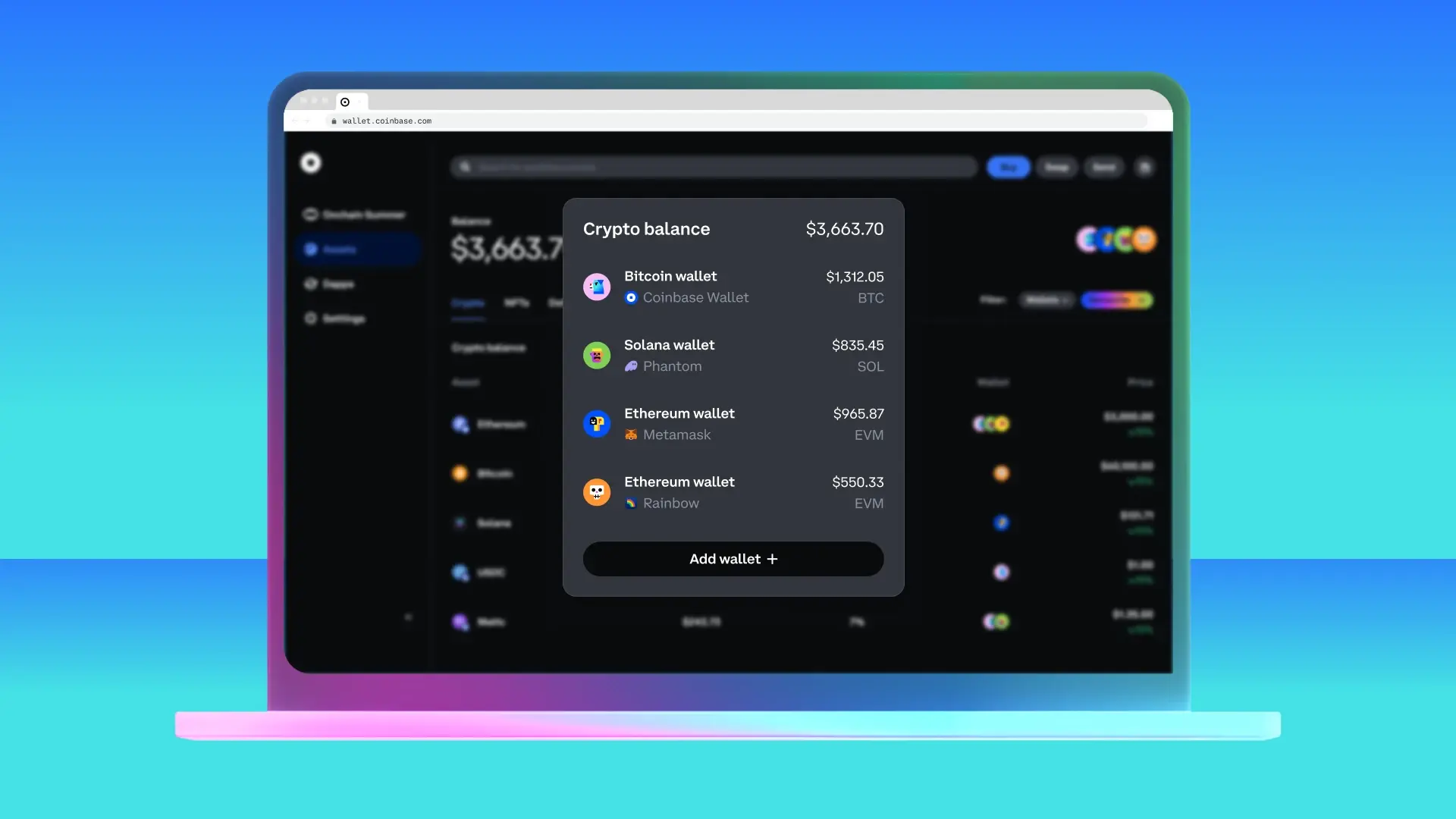

A cryptocurrency wallet, or coinbase wallet, is an application or hardware device which contains the cryptocurrency keys and allows users to access cryptoassets. Crypto vaults do not actually "store" your currency the way normal safes do. As a matter of fact, they store your private keys on the blockchain that are safe digital credentials, enabling you to access your digital assets.

Simplified even further, it is like a key with keys to all of your stuff on the blockchain. Vaults possess an address and private keys which must sign transactions concerning cryptocurrency. Any person possessing a private key can take ownership of the coins that belong to the address.

Types of Crypto Wallets

There are various kinds of digital asset storage. However, they are generally differentiated as warm and cold wallets. Both of them have their fair share of pros and cons. So, it's upon you to assess your needs and choose wisely. You can compare the types of vaults as we cover them.

Hot Wallets

Hot wallets are online and, as such, very convenient for frequent transactions. In contrast, their being online makes them more vulnerable to hacking and other kinds of cyber threats. Hot wallets will be ideal for those users who need quick access to their funds for trading, spending, or interacting with decentralized apps or simply dApps.

Here are the main types of hot digital locker:

Mobile Wallets

These are applications and software programs designed for smartphones. As a result, the mobile wallets offer portability and ease of use. The mobile blockchain vault would be ideal for users who operate their crypto while on the go. Some prominent examples of mobile wallets include Trust Wallet and Exodus.

Best For: For everyday transactions, mobile users, and beginners alike.

Web Wallets

The web wallets are browser-based; thus, these can be accessed from any internet-enabled device. Web key keepers normally come from third-party providers and exchanges. MetaMask and MyEtherWallet are some of the most commonly used web wallets for digital assets.

Best For: Quick access, interacting with dApps, and users who prefer browser-based solutions.

Desktop Wallets

Desktop key keepers are software applications and programs installed on your computer. These applications are getting more popular for their balance in security and convenience because they are only online when your computer is connected to the internet. Electrum and Atomic Wallet are some of the biggest names for this digital locker.

Best For: Users who like to manage their crypto on a computer and are looking for an option that's secure yet accessible.

Cold Wallets

Cold wallets, on the other hand, are offline storage options that offer better security for longer holding purposes. Since these options are offline, they cannot be vulnerable to online hacking. They can be ideal for all those users who prioritize security over convenience, especially if one is holding a significant volume of crypto.

Hardware Wallets

Hardware storage wallets are physical devices, somewhat similar to USB drives, which store your private keys offline. Hardware key keepers represent one of the safest options to store crypto. Some commonly used hardware digital lockers include Ledger Nano X and Trezor.

Best For: Long-term investors, advanced users, and those with sizeable crypto holdings.

Paper Wallets

Next, we have paper wallets. A paper storage solution is a physical printout of your private and public keys, usually in the form of a QR code. Though highly secure against online threats, paper key keepers are less user-friendly and prone to physical damage or loss.

Best For: Users who want maximum security and are comfortable with the manual management of their keys.

Key Factors to Consider When Choosing a Crypto Wallet

You must consider many factors when choosing the proper crypto storage for your needs. As it is much different from storing your fiat currencies. You can have a great experience if you choose the ideal storage system. However, if you fail to choose the right one, you will have to go through many challenges in the future.

So, here are the things that you need to consider before investing in a particular storage solution.

Purpose of the Storage

To be able to choose a storage, you need to define your main use case first. Will you use the digital locker for daily transactions, trading, or long-term storage? If you buy, sell, or transfer crypto frequently, a hot vault- a mobile or web digital asset storage solution- will best suit your needs due to convenience and accessibility.

On the other hand, hardware or paper cold wallets will be more suitable for long-term investment purposes or if you want to hold large volumes safely. If you are interested in staking, DeFi activities, or NFT support management, consider that the storage of your choice may support these activities. Understanding your purpose will help narrow down the type of digital locker that best fits your needs.

Likewise, your needs will differ significantly if you’re into crypto gambling. For gambling and crypto casinos, you’ll want a vault that allows quick and seamless deposits and withdrawals to and from top crypto gambling sites and platforms. Hot storage solutions, particularly mobile or web options, are often the best choice for crypto casinos because they enable fast transactions and easy access to your funds.

Additionally, ensure the storage supports the cryptocurrencies accepted by your preferred gambling sites. Some even integrate directly with gambling services, streamlining the process further.

Security Features

Security should always be the first priority for your digital assets. You have worked hard to earn this asset, and you should secure them in the same way. Secure storage ensures that your digital assets and crypto currencies are protected from hackers, scams, and other threats. Here are some key security features you need to consider.

Private Key Control

The most important parts of your crypto storage are your private keys, which can be regarded as your digital signatures. These are digital keys that give you control over funds on the blockchain. Once somebody has your private keys, they can access your crypto.

Ensure the storage grants you full access to your private keys. Do not use custodial wallets, as some exchanges will offer these, where a third party holds onto your keys. Understand that you don't own your crypto if you do not have control over your keys.

Choose a non-custodial vault, meaning you own the storage and have sole access to your private keys.

Encryption

Encryption is a process that changes your data into an unreadable format except with a decryption key. This is an assurance that even when the vault is compromised, data integrity remains unreadable.

Encryption secures sensitive information, like private keys and information about your transactions, against access by third parties. If encryption and proper verification of the transaction are lacking, it's very easy for hackers to get sensitive data and misappropriate it.

Crypto storage should use some form of advanced encryption standard, such as AES or similar protocols, to keep your data secure. Most reputable brands brag about the methods of encryption within their documentation.

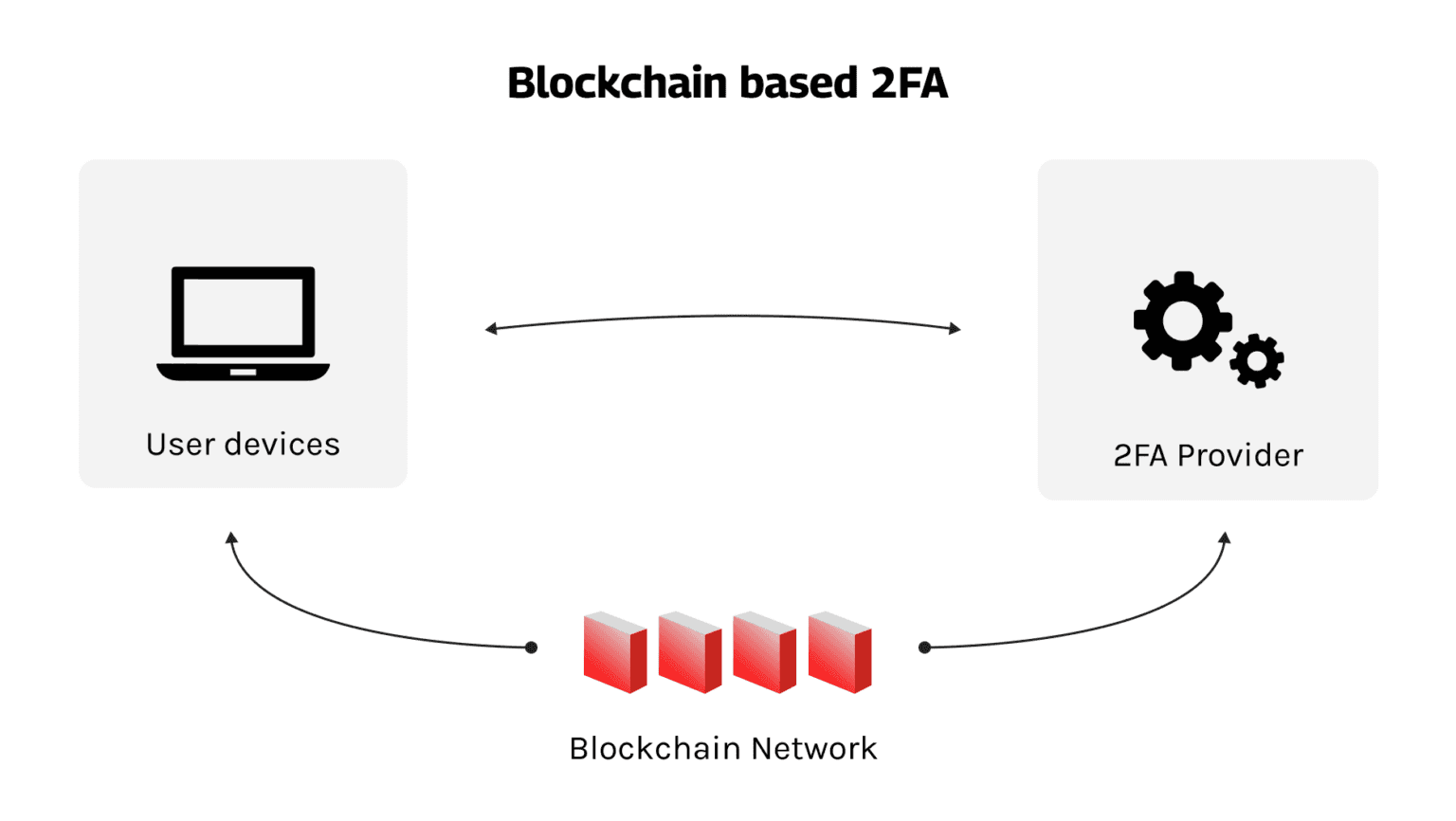

Two-factor authentication (2FA)

2FA incorporates an additional layer of security for your portfolio, with a secondary form of verification besides your password. That can be a code sent to your phone, an authenticator app, or maybe biometric authentication fingerprint scanning.

2FA can be essential if, unfortunately, your password is stolen, as nobody will get into your digital locker without a second verification step. This seriously reduces the risk of unauthorized access.

So, always opt for 2FA, especially on a web or mobile crypto vault.

Backup and Recovery Options

Losing access to your bitcoin wallets can also equate to losing your funds forever, and that's why backup and recovery options are important. Recovery phrases, more commonly known as seed phrases, you can set up in 12-24 sets of words, which can restore your crypto vault when you no longer have it.

That is to say, you forfeit all opportunities to access this crypto once more. In that case, once your device goes missing, becomes stolen, or gets destroyed, the recovery phrase assures you that, yes, one can recover lost funds.

Open-Source Code

Open-source crypto storage solutions have their code publicly open to any person to review, audit, and upgrade. This complete transparency builds confidence that the vaults as free from secret weaknesses and hidden malignancies.

Open-source solutions are more secure because they are under constant scrutiny from the community. Vulnerabilities, if any, get discovered and fixed quickly, hence reducing the possibility of their exploitation.

Additional Security Considerations

While the above-mentioned features are the most important, here are a few more to look out for regarding safety considerations:

- Multi-Sig Support: A few crypto storage solutions can enable multi-sig wallets that require multiple confirmations before a transaction can be broadcast. That's great for shared accounts or added security, so one point of failure doesn't exist anymore.

- Regular Updates: Keep the software or firmware of your vault up to date to avoid newly emerging threats. Most updates are put out by developers for patching vulnerabilities or adding security features.

- Phishing Protection: Be very cautious about phishing; you can be conned into giving away your private keys or recovery phrases. Only download crypto applications and software from official sites and avoid suspicious links.

Supported Cryptocurrencies

Not every crypto storage supports every cryptocurrency, so that is one of the first things you want to check: whether the crypto vault supports the coins or tokens you already have or will invest in. For example, holding Bitcoin or Ethereum and some altcoins can be one thing for which you will need support for multi-blockchains and smart contracts.

Some crypto storage is designed only for specific cryptocurrencies, while others support the big variability of coins and tokens. If you deal with newer projects or niche cryptocurrencies, ensure that it supports them.

Reputation and Reviews

A crypto storage’s reputation can speak a lot about reliability and trust issues. Reviews by users, in addition to reviews about any vault, should also be considered prior to making your choice. Reviews related to blockchain safety’s performance, security, and support should be examined. Moreover, see whether some popular source or crypto influencer recommends that option.

User Interface

A user-friendly interface is essential, especially if you’re new to cryptocurrencies. The wallet should be easy to navigate, with a straightforward setup process and intuitive design. Look for distinct features like transaction history visible, easy send/receive functions, and customization options.

A decent UI may mean that dealing with your crypto is frictionless; a badly implemented one causes frustration and/or mistakes.

Cost

Some crypto vaults are free, while others may entail costs such as storage fees and crypto exchange fees on the transactions made with your crypto. For example, you have to buy hardware storage, like Ledger or Trezor, for securely storing your crypto currency and assets over a long period of time.

Some charge per transaction or currency swap, while others may have premium features you can subscribe to. Check for other extra costs, like any withdrawal fees charged on exchange-based storage solutions. However, these costs are relatively lower than fiat currency and other investment strategy.

Best Cryptocurrency Wallet Recommendations Based on User Needs

We have compiled a list of crypto storage solutions based on your needs. Look through the wallet types, needs and best for to select the ideal one for you.

| User Need | Wallet Type | Best For | Recommended Wallets |

|---|---|---|---|

| Beginners | Software (Mobile/Desktop) | Easy-to-use interface, beginner-friendly setup | Exodus, TrustWallet, Coinbase Wallet |

| Security-Focused Users | Hardware | High-level security for storing large amounts of crypto | Ledger Nano X, Trezor Model T, Ledger Nano S Plus |

| Frequent Traders | Mobile /Exchange | Quick access to funds for frequent buying and selling | MetaMask, Trust Wallet, Binance Wallet |

| Privacy-Conscious Users | Privacy | Maximizing privacy and anonymity when transacting crypto | Samourai Wallet, Wasabi Wallet, Monero Wallet |

| Storage and Organization | Multi-Currency | Storing and managing multiple types of cryptocurrencies | Exodus, Electrum, Jaxx Liberty |

| Low Fees Users | Light (Web/Software) | Users who want to avoid high transaction fees | Trust Wallet, Coinomi, Electrum |

| NFT Enthusiasts | Crypto storage for NFTs | Storing and managing NFTs along with crypto | MetaMask, Trust Wallet, Coinbase Wallet |

| DeFi Users | DeFi vault | Accessing decentralized finance (DeFi) platforms | MetaMask, Argent, Coinbase Wallet |

| Long-Term Holders | Cold crypto Storage solution | Secure long-term storage of crypto with minimal risk of hacking | Trezor Model T, Ledger Nano S Plus, Coldcard |

| Advanced Users | Full Node storage | Complete control and validation of blockchain data | Bitcoin Core, Fullnode Wallet, Armory Wallet |

Step-by-Step Guide to Choosing the Right Wallet (Vault)

Here is a step-by-step guide on how you can choose the right vault for your use.

- Step 1: Identify Your Goals - Determine your main use case: trading, holding, or gambling.

- Step 2: Assess Security Needs - Decide whether you need advanced features of security, such as 2FA or cold crypto storage.

- Step 3: Check Supported Coins - Make sure the crypto storage supports your preferred cryptocurrencies.

- Step 4: Evaluate Compatibility - Choose crypto storage that works on your preferred devices: mobile, desktop, etc.

- Step 5: Test User Experience-test various vaults and find out which has a user-friendly interface.

- Step 6: Research Reputation-read reviews of every other vault; know what the crypto community thinks about this vault.

- Step 7: Consider Extra Features-some features to look out for in your chosen wallet include staking, integration with dApps, and in-built exchange.

- Step 8: Review Costs-check upfront costs, transactional fees, or any subscription model.

- Step 9: Prioritize Backup: Make sure the vault provides a recovery phrase and backup options.

- Step 10: Make Your Decision: Select the vault that best fits your needs and preferences.

Security Tips for Crypto Storage Solution

If you are already using a crypto vault or are opting to start using it, you must be well aware of the potential risks of managing and using these solutions. So, here are some security tips for a safe experience.

- Keep private keys secure: never share them, and store them in an offline safe place.

- Use strong passwords and enable two-factor authentication (2FA) for added security.

- Regularly back up your crypto vault by writing down your recovery phrase and storing it in a safe place.

- Avoid using public Wi-Fi when accessing your crypto solution; use a VPN for extra protection.

- Keep your crypto solution software and device firmware updated to protect against vulnerabilities.

- Be cautious of phishing scams: Only download software and applications from official sources and avoid suspicious links.

- Consider using a multi-signature storage solution for added security, requiring multiple approvals for transactions.

- Monitor your vault’s activity regularly and set up alerts for unauthorized transactions.

- Limit exposure by keeping only small amounts in a hot crypto vault and storing the majority in cold storage.

- Stay informed about the latest security threats and best practices in crypto.

Conclusion

The ultimate cryptocurrency wallets for you are a matter of personal choice, considering your specific needs and personal preferences. By following these steps and tips in the guide, you will make a well-thought-out choice: your crypto assets will be safe, ready, and available to support you in reaching your financial objectives. Welcome your crypto journey, keeping in mind that security and education are your biggest allies. Be careful, stay tuned, and enjoy all the benefits which cryptocurrencies can offer.

Some common questions

What is the difference between a hot wallet and a cold wallet?

Hot crypto wallets are those that keep your crypto keys online for frequent usage. It includes mobiles, web vaults, or desktops. On the contrary, cold storage of crypto is an offline platform for storing your assets. It includes hardware and paper storage solutions.

Can I have just one digital asset vault for all my cryptocurrencies?

That would depend on the vault you chose. For example, Exodus and Atomic Wallet can support more than one cryptocurrency, while some others have been developed to deal with particular coins only. Always ensure the crypto storage supports those cryptos that you own or intend to invest in.

How do I keep my crypto wallet secure? Here is how you keep your crypto vault safe and secure:

- Keep your private keys and recovery phrases offline and secure.

- Use strong passwords and enable two-factor authentication (2FA).

- Regularly update your crypto storage software and avoid using public Wi-Fi.

- Be cautious of phishing scams and only download the application or software from official sources.

**What happens if I lose my recovery phrase?**If you lose your recovery phrase-aka a seed phrase-you might never recover your wallet and funds again. You should write down the recovery phrase and store it in a safe, offline place at all times.

**Are hardware crypto storage worth the investment?**Yes, it is worth investing in hardware vaults like Ledger or Trezor if you are holding considerable amounts of cryptocurrency. They hold your private keys offline, making them the safest form of cold storage, perfect for long-term holding.

Can I gamble with a crypto vault? Of course, many crypto vaults, such as MetaMask and Trust Wallet, are perfect for gambling because they offer fast transactions and are supported by most of the gambling websites. Make sure that crypto storage supports the cryptocurrency accepted by your favorite gambling website.