Bitcoin Vs Ethereum: Which one is Better?

Discover the key differences between Bitcoin and Ethereum, explore their unique features, and find out which cryptocurrency is better suited for your investment goals and needs. Dive into the debate and make an informed decision.

The first cryptocurrency was launched in 2008, and the rest is history. There are around a thousand cryptocurrencies worldwide and among them, Bitcoin and Ethereum hold the top position in the list. However, the debate of “Bitcoin vs Ethereum” is unsettled. The main reason is that each cryptocurrency has its own uniqueness.

Bitcoin was the first cryptocurrency developed by Satoshi Nakamoto. Today, it is considered as “Digital Gold” which is why people are holding onto it as an investment.

Later, Ethereum was developed and introduced as a better version of Bitcoin. It was created to provide a platform for smart contracts and decentralized applications (DApps).

So, who is the winner of the “Bitcoin vs Ethereum” marathon in your opinion? It must be confusing and it is quite obvious as it requires in-depth research. And, this is where this blog will help you. Here, you will explore the basic concepts, similarities, key differences, pros, and cons of each one. Then, finally, you can decide on your own, which one is the best.

So, let’s get onto it.

Understanding the Basics

What is Bitcoin?

Bitcoin is the first cryptocurrency developed by Satoshi Nakamoto in 2009. It is a decentralized digital currency for peer-to-peer transactions, in simple words sending money directly to the other party without the need of the bank. Also, to make it secure, it records all transactions in a transparent digital ledger called the blockchain.

As mentioned above, Bitcoin is considered a “Digital Coin” as it has a limited supply of a fixed number of Bitcoins making it resistant to inflation. Hence, you can use Bitcoin to secure your wealth against the effects of economic uncertainty like real gold.

What is Ethereum?

Ethereum was launched in 2015 by Vitalik Butrein and his team as an ecosystem. Here, you can build decentralized applications and execute smart contracts. For example: consider a scenario where you are renting an apartment. So, you can replace a traditional contract with a smart contract in Ethereum to make it more secure.

Now that you have a basic understanding of both cryptocurrencies, we will explore their similarities before going for the key differences.

Similarities between Bitcoin and Ethereum

Since they both are a part of the same technology, they somehow feel similar to each other. And, here you will get to know these similarities in the following points:

- Bitcoin and Ethereum are digital currencies that can be traded online and held onto it as an investment.

- Both operate on blockchain technology to make the transaction more secure and transparent.

- There is no centralized control of these two technologies taking the middleman out of the scene.

- Both technologies allow the user to make direct transactions even across borders without the need for a bank.

- The transactions in both technologies keep the identities hidden to maintain the privacy of the users.

- You can access them both from anywhere in the world with the help of the internet.

- Both Bitcoin and Ethereum are the face of blockchain technology.

- Both cryptocurrencies have introduced financial products like Bitcoin ETF (Exchange Traded Fund) and Ethereum ETF so that investors can engage without directly buying them.

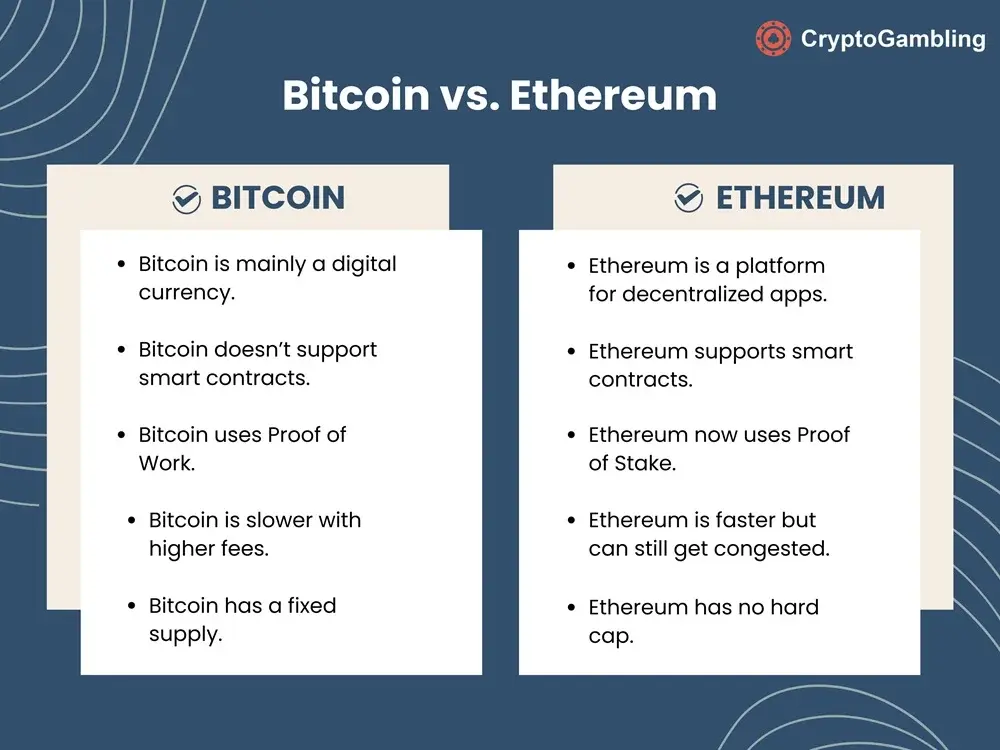

Key Difference: Bitcoin Vs Ethereum

1. Purpose

Bitcoin

Bitcoin was first developed to serve as a decentralized digital currency that allows users to make direct transactions taking out the mediators like banks or any payment process. The main aim was to provide an alternative system to send/receive money that operates without any central control like fiat currency.

But, as time passed, people viewed it as a store of value and started investing in Bitcoin to save their wealth against inflation and economic instability.

Ethereum

The aim of developers of Ethereum isn’t limited to just a cryptocurrency. The main idea was to provide a platform for executing smart contracts and building decentralized apps(DApps). As a result, developers can create applications to automate processes and execute deals without the need for human assistance.

Now, Ethereum aims to serve the new internet(Web3) that allows users to have better control over their data.

2. Consensus Mechanism: How Transactions Are Verified?

Bitcoin

Bitcoin verifies its transaction through a mechanism called Proof of Work. Here, miners, individuals who can add new blocks of transactions, compete with each other to solve complex mathematical problems. Then, whoever solves the problem faster gets to add a block of transactions and gets a new coin as a reward.

PoW ensures security offering more complex mathematical problems to alter any part of the already existing part of the blockchain. As a result, it requires intensive computational power to change the transactions making it secure.

Ethereum

Although Ethereum was using PoW with its first version, with the introduction of Ethereum 2.0, it shifted to Proof of Stake(PoS). Here, there are no miner, but validators, who stake their own coins to ensure the new blocks are genuine and errorless.

PoS offers better security than PoW, as validators risk their own hard-earned coins to ensure security. If they try to cheat or be careless about the transactions, they lose all the coins they have risked and provided to other validators with honest behavior.

3. Total Supply to the market

Bitcoin

Bitcoin is better with the total supply to the market as it has a maximum limit of 21 million coins, which is also the main reason to consider it as gold. But, how does it maintain the constant supply as the mining of Bitcoin is ever going? Here comes the process called “Halving”, which decreases the mining rate by half every four years.

How many days does it take to mine 1 Bitcoin?

Based on an article by Coinwarz, it takes around 4,505.1 days to mine a single Bitcoin on January 24, 2025.

Ethereum

In contrast, Ethereum does not ensure a fixed supply to the market. However, Ethereum also implemented a mechanism, EIP-1559 upgrade, to maintain the supply and control inflation.

Whenever a user adds a transaction in the network, the user pays a transaction fee which is the sum of the base fee and priority fee. And, EIP-1599 mechanism removes the base fee from the circulation to ensure the maintenance of inflation.

How many days does it take to mine 1 Ethereum?

Based on an article by Zenledger, it takes around a month to mine 1 Ethereum if you are mining as a group and longer if you are mining solo.

4. Applications

Bitcoin

The main application of Bitcoin is peer-to-peer payment as you can transfer funds directly to the other party, even across borders, without any mediators and maintaining high security.

Further, the transaction fees are comparatively lower than the fees of traditional banking methods. As a result, it becomes a better option for sending money across borders or buying online.

Ethereum

The key application of the Ethereum blockchain is building smart contracts as it serves as a better platform than Bitcoin.

A Smart Contract is a self-executing contract with its terms written directly into the code. As a result, it automatically executes the agreement after meeting the given conditions. Additionally, it removes the mediators like lawyers through the automation process reducing the cost of their fees.

For instance, when you are buying a building, a smart contract can automatically transfer the ownership to you, once you complete the payment.

Pros and Cons of Bitcoin and Ethereum

Bitcoin

Pros

- Bitcoin offers a secure transfer of funds without dependence on banks and lower transaction fees.

- It takes an intensive computational system to alter the transaction which is nearly impossible.

- The identity of both parties is hidden to maintain privacy.

- Bitcoin price is not as volatile as Ethereum price making it a better investment.

- Since there is limited supply to the market, inflation is out of the equation.

Cons

- Bitcoin is not widely accepted making it harder to use it for daily-life purchases.

- If your wallet is lost or corrupted, there is no method to recover the Bitcoins in the wallet.

- With the requirement of a high computational system to mine Bitcoin, there is a large consumption of energy.

Ethereum

Pros

- Ethereum offers multiple applications like decentralized finance, and non-fungible tokens(NFTs) making it versatile.

- Implementation of Proof of Stake(PoF) significantly reduces the consumption of energy.

- The use of Smart contracts can enable users to execute the contract automatically when conditions are met.

Cons

- As Ethereum can be created infinitely, there is a risk of inflation.

- Smart contracts and DApps can be complex for normal people for now.

- As the number of users increases, there are scalability issues like congestion on the network, higher transaction fees, and slower transaction speeds.

Conclusion

Now that we are at the end of this blog, it is necessary to recognize that both Bitcoin and Ethereum possess unique traits making it harder to decide the winner of the “Bitcoin Vs Ethereum” debate.

Bitcoin offers a secure, low-fee transaction of funds without the need for mediators and constrictions of central entities like the government. And, on the other hand, Ethereum is a whole ecosystem with the ability to support smart contracts and DApps.

So, we cannot just decide the winner of “Bitcoin Vs Ethereum”, it depends on your needs and how you use them. And, as we move forward, they can exist as complementaries rather than competition to each other.

How can I buy cryptocurrency in Canada?

Wealthsimple crypto is the ultimate answer to buy cryptocurrency with few taps. Further, Wealth Simple crypto allows you to swap one cryptocurrency with another one with just half the transaction fees.

Should I buy Bitcoin now?

The answer to your question is conditional, you cannot just decide based on answers available on the internet. You have to do your own research based on your needs and plans.

Is Ether a good investment?

Yes, Ether can be a good investment in 2025 as many analysts have predicted its price will soar by double with the increase in the application of smart contracts and decentralized finance (DeFi).

Can I use cryptocurrency for gambling?

Since there are many myths about crypto-gambling, it can confuse you. But, the answer is YES!!!, you can use cryptocurrency for gambling as there are many crypto-gambling sites in Canada itself.